A co-operative society is an association of persons who have come together with a common purpose of pooling their resources together for mutual economic and social benefit. This blog therefore dedicates itself to this important sector of our economy by posting all available information about the movement and also providing new information on the movement.

Monday, 30 September 2013

CO-OPERATIVES SOCIETIES ACT ON AMENDMENT OF BY-LAWS

Co-operative Societies Act CAP 490 Section 8 states:

(1) A co-operative society may, subject to this Act, amend its by-laws, including the by-law which declares the name of the society. (2) No amendment of the by-laws of a co-operative society shall be valid until the amendment has been registered under this Act, for which purpose a copy of the amendment shall be forwarded to the Commissioner in the prescribed manner.

(2) No amendment of the by-laws of a co-operative society shall be valid until the amendment has been registered under this Act, for which purpose a copy of the amendment shall be forwarded to the Commissioner in the prescribed manner.

(3) If the Commissioner is satisfied that any amendment of the by-laws of the Co-operative society is not contrary to this Act and any rules made thereunder, he may register the amendment.

(3A) The Commissioner may, if he is satisfied that an amendment under this section was effected pursuant to a misrepresentation or concealment of a material fact by the person applying for registration, cancel the amendment.

(4) An amendment which changes the name of a co-operative society shall not affect any right or obligation of that society or any of its members, and any legalproceedings pending may be continued by or against the society under its new name.

(5) When the Commissioner registers an amendment of the by-laws of a cooperative society, he shall issue to the society a copy of the amendment certified by him, which shall be conclusive evidence of the fact that the amendment has been duly registered.

(6) In this section, “amendment” includes the making of a new by-law and the variation or revocation of a by-law, but excludes the variation of the registered address of a co-operative society where this forms a part of the bylaws of such a society.

(1) A co-operative society may, subject to this Act, amend its by-laws, including the by-law which declares the name of the society.

(2) No amendment of the by-laws of a co-operative society shall be valid until the amendment has been registered under this Act, for which purpose a copy of the amendment shall be forwarded to the Commissioner in the prescribed manner.

(2) No amendment of the by-laws of a co-operative society shall be valid until the amendment has been registered under this Act, for which purpose a copy of the amendment shall be forwarded to the Commissioner in the prescribed manner.(3) If the Commissioner is satisfied that any amendment of the by-laws of the Co-operative society is not contrary to this Act and any rules made thereunder, he may register the amendment.

(3A) The Commissioner may, if he is satisfied that an amendment under this section was effected pursuant to a misrepresentation or concealment of a material fact by the person applying for registration, cancel the amendment.

(4) An amendment which changes the name of a co-operative society shall not affect any right or obligation of that society or any of its members, and any legalproceedings pending may be continued by or against the society under its new name.

(5) When the Commissioner registers an amendment of the by-laws of a cooperative society, he shall issue to the society a copy of the amendment certified by him, which shall be conclusive evidence of the fact that the amendment has been duly registered.

(6) In this section, “amendment” includes the making of a new by-law and the variation or revocation of a by-law, but excludes the variation of the registered address of a co-operative society where this forms a part of the bylaws of such a society.

Sunday, 29 September 2013

QUALITIES OF GOOD INFORMATION SYSTEM-SACCOs

Good information system should possess the following qualities:

The co-operative should provide relevant information. Relevance is determined by the user of the information and therefore the management of the co-operative should first define the objectives of the various reports to be produced. Based on the user, the system should generate the following:-

The co-operative should provide relevant information. Relevance is determined by the user of the information and therefore the management of the co-operative should first define the objectives of the various reports to be produced. Based on the user, the system should generate the following:-- Detailed daily operational/transactional reports that are accurate for use by supervisors.

- Summarized current and projected information, regardless of whether internally or externally sourced, that is likely to affect performance for use by the managers.

- Highly processed information for strategic planning and management control, obtained from within the co-operative for use by directors and the CEO.

The system should also be designed to generate exceptional reports.

The information should be timely for it to be acted upon. The officer in charge of ICT should review the system constantly to assess its speed and recommend upgrading or replacement.

Information should be free from errors and the user should be notified of any assumptions or estimates.

The co-operative should obtain information from authoritative sources only.

(Excerpt from Chapter 4: Co-operative Society Management and Prudential Guidelines Manual Template-Developed by VAS Consultants Ltd for Department of Co-operatives).

Friday, 27 September 2013

Understanding a Co-operative Society

What is a co-operative society?

A co-operative society is an association of persons who have come together with a common purpose of pooling their resources together for mutual economic and social benefit.

Types of co-operatives societies in Kenya

a) Savings and credit co-operative societies

These are formed to provide financial support to members. They accept deposits from members and grant them loans at reasonable interest rates in times of need.

b) Housing co-operatives societies

These are co-operative societies formed to provide residential houses to members. They purchase land, develop it and construct houses or flats and allot the same to members. Some societies also provide loans at low rates of interest to members to construct their own houses.

c) Consumer co-operative societies

These societies are formed to protect the interest of general consumers by making consumer goods available at reasonable price. They buy good directly from producers or manufacturers thereby eliminate middlemen in the process of distribution.

d) Agricultural/marketing/farmers co-operatives

These are formed by small farmers to work jointly in marketing their produce and thereby enjoy the benefits of large-scale farming.

e) Producer co-operative societies

These societies are formed to protect the interest of small producer by making available items of their need for production like raw materials, tools and equipment, machinery, etc..

f) Multipurpose co-operative societies

These are co-operatives that deal with more than one activity. The Ministry of Co-operative Development and Marketing discourages the formation of such co-operatives as their overall performance has been found wanting.

What are the objects of a co-operative society?

The main object of a co-operative society is to organize and promote the economic interest of its members in accordance with the Co-operative Principles and Values. The specific objects include:-

- promotion of thrift among members-opportunity for accumulation of savings/deposits; loans at fair and reasonable rates of interest

- to provide opportunities for members to improve their economic and social conditions

- perform those functions and exercise powers designated for Co-operatives Societies under applicable by-laws.

The Co-operative Values:

- Self-help

- Mutual responsibility

- Equality

- Equity

- Honesty

- Openness

- Social responsibility

The seven universal co-operatives principles:

- Voluntary and open membership

- Democratic member control

- Economic and participation of members

- Autonomy and independence

- Education, training and information

- Co-operation among co-operatives

- Concern for community

Structure of co-operative movement in Kenya

The co-operative movement in Kenya is divided into four distinct divisions namely:-

a) The National Apex:

Kenya National Federation of Co-operatives Ltd (KNFC)- defunct, was formed on 28th April 1964 as the Apex Co-operative organization of the Kenya Co-operative Movement with the mandate to lobby, advocate for, network, collaborate and unite all co-operatives in Kenya. It has been replaced by Co-operative Alliance of Kenya that was inaugurated in 2010.

b) National Co-operative Organizations:

- The Co-operative Bank of Kenya

- The Co-operative Insurance Company of Kenya CIC

- Kenya Union of Savings and Credit Co-operative KUSCCO

- Kenya Rural Sacco Societies Union Limited KERUSSU

- National Co-operative Housing Union Ltd NACHU

- Co-operative Collage of Kenya

- Kenya Planters Co-operative Union KPCU-registered both as a company and a co-operative society

- New Kenya Co-operative Creameries Ltd KCC

Secondary Co-operative Societies:

Comprises of all co-operatives unions countrywide.

Primary Co-operative Societies:

Comprise over 12,000 primary co-operative societies registered countrywide.

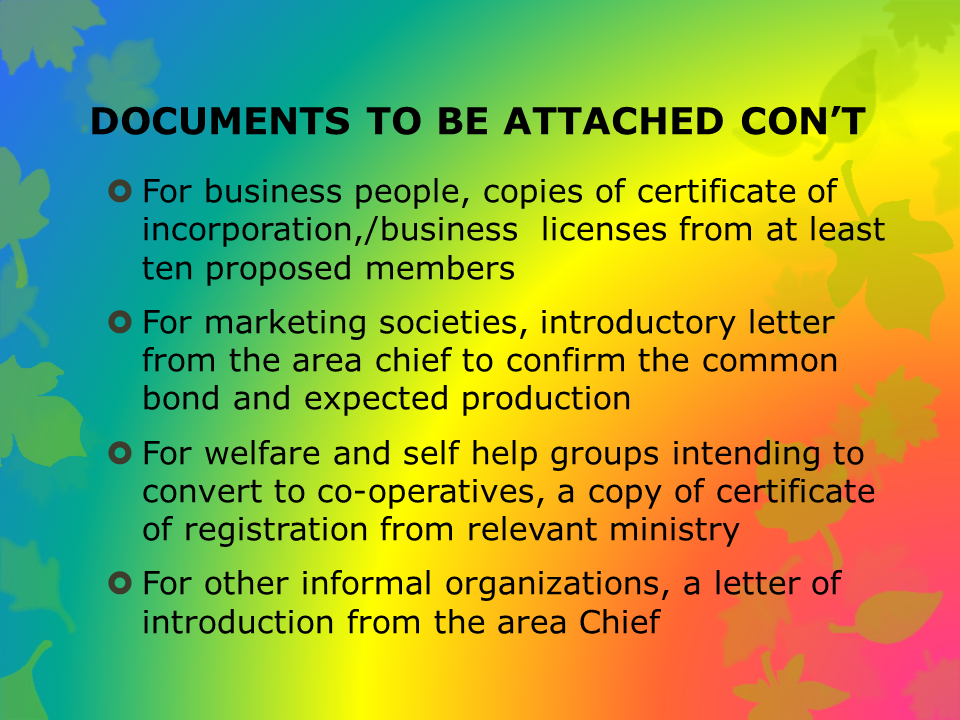

Registration of Co-operative Societies

Pre-requisites

The co-operative Societies Act, Chapter 490 of the Laws of Kenya, states that for a society to be registered with or without limited liability, it:

- has to have its object as the promotion of the welfare and economic interest of its members and

- has incorporated in its by laws the co-operative principles

Essentials for registration of a co-operative societies

For a society to be registered under the Act, it must:

- in the case of the primary society, consist of at least ten persons all of whom shall be qualified for membership of the co-operative society

- in the case of a co-operative union, it consists of two or more registered primary societies

- in the case of an apex society, consist of two or more secondary societies

Procedure for registration

- an application is made to the commissioner for co-operatives development in the prescribed form and signed by at least ten would be members

- the application is accompanied by four copies of the proposed by-laws of the society in English and the person or persons by whom or on whose behalf such application is made, shall furnish such information with regard to the society as the commissioner may require

- if the commissioner for co-operatives development is satisfied that a society has complied with the Act and any rules made there under and if the proposed by-laws are not contrary to the Act, he may register the society and its by-laws.

Registration Documents

- The proposed by-laws in four copies

- Filled application for registration form in four copies

- Supplementary information form in four copies (if any)

- Economic appraisal in four copies

- In case of salaried workers with check-off agreement with employer, a letter from the employer is needed.

Co-operative Corporate Governance

What is co-operative corporate governance?

Corporate governance takes into account public policy, national values and ethics. It covers systems by which the individual corporations regulates itself for competitiveness and sustainability through practices and procedures for supervising, monitoring, regulating and controlling its affairs. Regulatory authorities, national trade and business associations, professional bodies and societies should all practice good corporate governance.

Co-operative corporate governance is about the use of power in co-operative organizations. It is concerned with the leaders who are the people who govern, that is, direct and control co-operatives.

Co-operative corporate governance also targets members of co-operatives. These are the main stakeholders. They are the people whose money is invested in the organization. They are the ultimate beneficiaries of well run co-operatives and the ultimate losers of badly run organizations and for this reason, they are the supreme authority.

For co-operatives to be efficient and productive, they must apply good corporate governance practices that seek to ensure that the power of the organization is used in a manner that ensures:

- effectiveness-that the co-operative society abides by and achieves the objects for which it exists.

- efficiency-that the undertaking of the organization are honest and have integrity.

- fairness-that the organization treats all its shareholders and the community in which it operates in reasonably and justly.

- transparency-that the organization is open about its activities and that it meets that information needs of all its stakeholders.

- discipline-that the organization complies with all the laws of the country, its by-laws and that it exercises self-control in all its dealings.

- accountability-that the organization is answerable to and satisfactorily explains its actions to its members/stakeholders.

- responsibility-that the organization exercises good judgment. That is able to make informed and astute decisions, act accordingly and accept the consequences of its actions, taking remedial actions where necessary.

- independence-that the organization acts of its free will, in its best interests and with the consideration for all its stakeholders and not according to the dictates of external interests.

- social responsibility-that the organization is sensitive to and that it responds to the needs of the members/society, for example by improving its products or where necessary developing new ones.

Why Good Corporate Governance

Good corporate governance can greatly enhance effectiveness, competitiveness and sustainability of the organization. This is important in the highly competitive global market. Members must demand good governance of their co-operative to ensure:

- that the organization achieve the objective for which they exist.

- that the organization are effective and make good returns on members’ investments.

- that the organization are innovative by improving on their products and introducing new ones.

- that the organizations are credible so that they can attract more members and savings.

- that the organizations are sustainable and continue to exist and be effective for a long time.

- that the organizations use resources efficiently and with due regard to the needs of future generations.

- that the organizations are responsible and that they contribute to well-being of the community in which they exist.

Authority and Duties of the Members as Stakeholders

Shareholders in the co-operative society must play their role in ensuring that their organizations are well-governed. In order to do this, they must keep themselves informed about their co-operative societies so as to be in a position to make independent and informed decisions on all issues on they are called upon to make decisions. Shareholders should ensure that they clearly understand the objects for which their co-operative are formed so that they can effectively hold directors they elect to account.

Shareholders have a duty to ensure that only competent and reliable persons, who can add value, are elected to the board of directors. They must also ensure that the board is constantly held accountable and responsible for the efficient and effective governance of the co-operative society so as to achieve corporate objectives, prosperity and sustainability.

Every co-operative should be led by an effective board which exercises leadership, enterprise, integrity and judgment in directing the co-operative society and which acts in the best interest of the co-operative in a transparent, accountable and responsible manner.

Accountability and Transparency

To enhance accountability and transparency in co-operative organizations, the leaders have to observe and adhere to the co-operative values of honesty, openness, social responsibility and caring for others. These values may be exercised while performing various activities of the co-operative organization as follows:

- meetings-convene and conduct co-operative meetings as specified in the Act and Rule and the co-operative by-laws.

- elections of leaders-have regular and timely elections and allow members to participate without interference such as rigging and other forms of influence.

- accounts and audit-maintain up to date an accurate records of the organization and ensure audited accounts are presented and read to members in time and members allowed to deliberate and resolve on them.

- budgeting procedures-budgeting for the organization should be participatory, with members originating ideas and giving final approval.

- recruiting of personnel-co-operative leaders should source personnel from open market and should avoid nepotism.

- code of conduct for leaders-co-operative societies should develop code of conduct and best practice for their leaders.

- delegation of duties-to enhance transparency and accountability, each co-operative should recruit experienced and professional persons to avoid board members acting as executives. Clear job description should be prepared for every position.

- training-training can do a lot to enhance transparency and accountability. It should be done in a participatory and leaner centered manner and be geared towards change.

- tendering and procurement-tendering should be done according to the provisions of the Public Procurement and Disposal Act and Regulations. Always seek for quality goods and services.EXCERPT FROM: Savings and Credit Co-operative Societies; Start-up Kit (Swiss Contact and Department of Co-operatives).

Rights and Obligations of a Member

Rights of a Member

A right is what a member of a co-operative deserves to be given, or is entitled to get, enjoy or feel. In order to enjoy these rights, a member must have paid the necessary membership fees and purchased at least one minimum share and also have deposits in the Sacco Society.

These rights are:-

- to attend and participate in general meetings.

- to elect and be elected to the organs of the society subject to this by-laws.

- to enjoy the use of all facilities and services of the society subject to the by-laws.

- to receive periodically and regularly or upon request a statement of account in respect of transactions with the society.

- to access all legitimate information relating to the society including: internal regulations, registers, minutes of general meetings, annual accounts, inventories and investigation reports at the registered office of the society subject to any regulations in force.

- to transfer shares.

- to share in the profits of the society, if any.

- to vote on all matters put before the general meeting of the society.

- to appoint a nominee.

- to ask for a special general meeting subject to the rules and the society by-laws.

Members Obligations/Duties

The conferment of rights to a member also demands that a certain obligations be fulfilled. A member's obligation is what the society expects from a member. As much as a member enjoys rights from the society, he has an obligation to:-

- attend and participate in passing resolutions at general meetings.

- observe and comply with all the society's by-laws and decisions made by organs of the society in accordance with the by-laws.

- buy and pay-up for shares or make any payments as provided for in the by-laws of the society.

- patronize the society's products.

- attend members' education meetings.

- repay loans as per the agreement.

- promote the society and its service or products.

- pay for the debts of the society at the time of liquidation where the assets are insufficient to meet liabilities.

- support projects of the society approved by the relevant authority.

Factors to be considered when borrowing a loan

1. Business concept

It is the duty of member to put together details of the investment to be undertaken- the purpose of the loan i.e. the loan for increasing stock, purchase of machine, purchase of building materials, purchase of land, etc.

It is the duty of member to put together details of the investment to be undertaken- the purpose of the loan i.e. the loan for increasing stock, purchase of machine, purchase of building materials, purchase of land, etc.

2. Character of borrower

Assess your character- how do you behave when you have money and when you don’t?

-put in safety measures to ensure you use the loan for the purpose intended/wisely.

-why are you borrowing? Is it because you need the loan or is it because the money is available?

-are you a trustworthy applicant? Hardworking?

3. Capacity to pay

This is the ability to repay credit if extended. Assess your own ability to repay the loan in line with society’s loan policy and your personal financial position.

Consider your capital standing or financial strength i.e. monthly financial obligations not on the palsy that may hinder you from repaying the loan or make you suffer pecuniary embarrassment.

4. Own contribution

This is the amount of funds borrower is willing to invest in the business. Do not expect your society to finance your project 100%

5. Collateral for loan

These are details on security put forward by the borrower in good faith as a guarantee that money borrowed will be repaid.

In co-operatives this is basically a guarantor. However, members should use other forms of security e.g. share certificates and insurance policy, in case the society loan policy allows.

6. Interest rate

Consider the interest rate of the loan to be borrowed and its effect on your income for the whole period of the loan repayment.

Members should concentrate on development loans for their own development and take school fees loan where necessary.

They should avoid unnecessary emergency loans at all cost because mostly one cannot do much and they reduce member’s ability to take a development loan.

RULES GOVERNING LOAN APPLICATION

An applicant shall be considered or accepted for the processing upon a members meeting the following conditions:

1. Must have been an active member of the society for a period f not less than six months

2. Must be consistent saver with the society for a period of not less than six months

3. Must be willing to conform to all rules, by laws and co-operative societies act

4. Must be a Kenyan citizen with a valid identity card and be a person of sound mind who has not been declared bankrupt or barred to contract for any reasons

5. Must be earning regular income either from business or employment

6. The loan application must be for prudent purposes and application must justify its legality by stating its purpose

7. Must be willing to make all necessary disclosures of information necessary to facilitate loan processing and guarantorship

How can mobilization of member funds be improved?

Cooperatives need to find ways to increase member funding, since this provides the lowest cost, lowest risk form of capital for operations and investment. As government and donor support continues to decline, increasingly this also becomes the only practical source of funding for cooperatives. Even where outside support is still available, the advantage of increased reliance on member funding is that it gives greater autonomy to the cooperative and lowers the risk of eventual withdrawal of outside funding.

The strategy for increasing member funding depends on the particular circumstances of the cooperative, the type of activity it is engaged in and its scale of operation. Among the strategies to consider are:

Improving operating efficiency

Improving efficiency can be important for the mobilization of funds. It enables a cooperative to offer more competitive prices, securing and keeping member loyalty.

Funding and efficiency are related. Cooperatives with sufficient funds are able to invest in training and technology to reduce costs, and to increase or improve production. Well managed, technologically efficient cooperatives are generally more likely to accumulate capital.

Promoting patronage

The more members use the cooperative’s services - that is by taking loans and saving with the the cooperative - the more funds the cooperative will receive. It is therefore important for the cooperative to promote patronage. This is most easily achieved when cooperatives provide services valued by members, offer competitive interest rates and prompt payments.

Giving priority to mobilizing member funds

Most cooperatives will have to rely on member generated funds to finance their operations. Members’ financial stakes in the cooperative enforce greater accountability of the cooperative to members, build member participation in decision making and strengthen cooperative financial self-reliance and operational autonomy.

There are a number of ways in which member funds are obtained. In many cases, increased levels of funding can be achieved through adjusting these methods:

· Non-refundable membership fees upon joining/entrance/registartion fees

These fees are often small, but they need not necessarily be so if new members are buying into a successful business that provides valuable services.

· Member shares

All members are required to purchase shares, which are usually the primary source of member capital. Shares purchased should earn dividends and are transferable to other members upon withdrawal from membership or given to his/her heirs in the event of the member’s death.

· Member deposits

Co-operatives can also consider increasing minimum monthly contributions.

Products

Other than loan products, co-operatives can introduce saving products e.g. holiday savings, withdrawable savings scheme, etc. Major source of affordable loans/credit. Why?

1) Core objective and best form of saving

2) Prerequisite for investment

3) Saving for retirement

4) Members earn GOOD returns at the end of the year

· Retention of surplus.

Surplus can either be retained by the cooperative as institutional capital, or paid out in patronage refunds to members following the close of each year. In practice, cooperatives often offer interest rates more favourable than those prevailing in the market, creating little surplus and making it impossible to offer patronage refunds. Whenever possible, these practices should be altered either to build up surpluses or increase patronage refunds and attract new members.

· Deferred payments

A surplus creates two opportunities for increasing capital available to a cooperative. One is the surplus retained, and the other is the patronage refund that is allocated but not immediately paid out in cash. During the period between the realisation of the surplus and the cash pay-out of patronage refunds, the cooperative has the use of the cash. Pay-out may take the form of a share or of an obligation to pay the member in the future.

Consider use of outside funding

In simple terms, the higher the institutional capital and member deposits, the more outside lenders such as banks and suppliers will be willing to loan funds to the cooperative. Care should be taken in borrowing, however since the higher the outside funding as a proportion of funds used, the higher the risk if something goes wrong.

Too much institutional capital?

For the majority of cooperatives in developing countries, the possibility of accumulating too much institutional capital any time soon is small. However, members should be aware that it is actually possible for the original purpose of the cooperative to be lost if the amount of institutional capital becomes too large.

This may result in the exclusion of new members, because present members do not want others to benefit from the services provided and surpluses produced by the capital accumulated.

Member financing builds the sense of member ownership

Cooperatives have always been referred to as “member-owned” organizations, yet in countries where cooperatives have depended too heavily on outsiders for financial support, that sense of ownership and personal financial stake has been lost. It is not uncommon to hear members and shareholders refer to their cooperative as the “government’s cooperative” instead of their own cooperative. This is largely because the financial stake or contribution of the membership of the cooperative is small relative to the non-member stake. In spite of the one-member-one-vote principle, the major suppliers of capital, in this case non-members, have the largest say and tend to determine the main priorities of the cooperative business. Cooperative member participation drops and the cooperative promise is weakened.

Conclusion

It is important to build the membership’s financial stake in the cooperative. This increases the sense of collective ownership, makes the cooperative’s management more accountable to serving members, strengthens member commitment and loyalty and thus provides a true and sustainable basis “or cooperation.

Adapted from http://www.fao.org/docrep/003/w5069e/w5069e07.htm

Labels:

Deposit,

Entrance Fees,

External Loans,

Funds,

Loan,

Registration Fees,

Registration of Co-operatives,

Sacco Policies,

Sacco Regulatory Authority,

Sacco Societies Act,

Sasra,

Save,

Save Money,

Shares

Location:

Ruiru, Kenya

LICENSE OF SACCO BY SASRA

1. Introduction

The Sacco Societies Regulatory Authority (SASRA) is empowered to license, regulate and supervise deposit taking Sacco Societies under the Sacco Societies Act 2008 (the Act), and the Regulations issued there under. The Act requires all Sacco Societies carrying out deposit taking business to apply for licenses from SASRA (Section 23 of the Act and Regulations 4). Deposit taking Sacco societies in the context of the Act refers to the Sacco Societies operating Front Office Savings Activity (FOSA).

2. Who should apply for license?

With effect from 18th June 2010, the date of publication of the Sacco Societies (Deposit Taking Sacco Business) Regulations, 2010:

All Sacco Societies intending to operate FOSA shall apply for license from SASRA (section 23 of the Act and regulation 4(2)); and

All Sacco Societies already operating FOSAs are required to apply for license from SASRA by 17th June 2011.

3. What are the licensing Procedures?

3. What are the licensing Procedures?

The licensing procedures are detailed in Section 24 of the Act and Section 4 of the Regulations. These procedures are split into five main stages as explained below.

3.1 First stage: Application for License

Duly complete and submit the “APPLICATION FORM FOR A LICENCE” coded SASRA 1/001) in the regulations for SACCO Societies (Deposit Taking Business) to SASRA. This form is available here. The completed application form should be accompanied by supporting documentation including:

a) a certified copy of the Sacco society’s registration certificate, issued under the Co-operative Societies Act [Cap 490] Laws of Kenya.

b) a verified official notification of the Sacco society’s registered head office and branches, if any;.

c) a certified copy of the Sacco society’s bylaws.

d) a certified extract of minutes of the general meeting resolution authorizing the application for deposit taking license. This requirement applies to Sacco Societies seeking to commence FOSA operations.

e) name of the proposed chief executive officer.

f) Certified copies of the financial statements for the last three years

g) Evidence that the Sacco society has adequate capital by completing and submitting the Capital Adequacy Return (downloadable from www.sasra.go.ke) as set out in Form 1 in the second schedule to the Sacco Societies (DT) Regulations, 2010. Refer to the guidance notes on capital adequacy for capital requirements at the point of making the application for license.

h) Business plan and Feasibility study available here

A Sacco Society must prepare and submit a comprehensive four year business plan in line with the transitional provisions (and feasibility study for a Sacco Society making the application to commence FOSA operations) detailing:

A Sacco Society must prepare and submit a comprehensive four year business plan in line with the transitional provisions (and feasibility study for a Sacco Society making the application to commence FOSA operations) detailing:

1. the vision and mission;

2. Scope and nature of business operations;

3. Economic and financial environment;

4. Organizational structure and management;

5. Financial and risks analysis;

6. Projected financial statements and analysis using the format provided in the regulations. The projections should show how the institution will meet the prudential standards within the plan period, namely:

1.

Capital adequacy – indicate sources of capital over the plan period.

Loans quality and provisioning – Evaluate the loan portfolio, age the delinquency and make provisions as appropriate.

Liquidity – plans on liquidity management in full compliance with regulatory requirements.

Investment – divesting to comply with regulation 48 (limits on property, equipment and financial assets).

Sustaining the asset structure and quality

2. Scope and nature of business operations;

3. Economic and financial environment;

4. Organizational structure and management;

5. Financial and risks analysis;

6. Projected financial statements and analysis using the format provided in the regulations. The projections should show how the institution will meet the prudential standards within the plan period, namely:

1.

Capital adequacy – indicate sources of capital over the plan period.

Loans quality and provisioning – Evaluate the loan portfolio, age the delinquency and make provisions as appropriate.

Liquidity – plans on liquidity management in full compliance with regulatory requirements.

Investment – divesting to comply with regulation 48 (limits on property, equipment and financial assets).

Sustaining the asset structure and quality

1. Control measures and monitoring procedures

The financial projections are based on the business plan and hence should assist in monitoring the strategic goals of the Sacco Society and therefore an implementation plan and monitoring framework should be included.

Note: Where the Sacco Society has a current business plan, the same should be reviewed in the light of the regulatory requirements and the four years transitional period.

h) Fit and Proper forms

Duly complete and submit the “Fit and Proper test” form (SASRA 01/002) with the application for license. The form should be completed by all persons proposed as directors and senior management as defined in the form. This form is available here.

3.2 Second Stage: Letter of Intent

SASRA will assess the application for fulfillment of the requirements in the first stage and if satisfied issue a Letter of Intent to the Sacco Society to put the following in place:

3.2.1 Institutional Infrastructure or business premises appropriate for deposit taking Sacco business. This includes but not limited to:

A banking hall;

A adequate working space;

Physical security measures; and

Strong room and safe.

The Sacco Society’s Information Management System must be capable of performing and accounting for all transactions and providing the minimum reports required by the Authority in an accurate and timely manner. The system should be operationally integrated and provide adequate security including data back up.

3.2.3 Risk Management policies and internal control systems

Sacco Societies face constant risks in the course of their business including credit, liquidity, interest rate, operational, reputation and regulatory risks. The Authority will require the Sacco Society to develop risk management policy framework addressing each of the risk identified. The risk management framework must address the following key considerations.

a. Clear definition of roles and responsibility of the Board and management in development, implementation and review of the risk management systems;

b. Adequate policies, procedures and limits;

c. Risk monitoring and information system;

d. Adequate internal controls and audit specific to each risk area.

3.3 Third stage: Onsite inspection

Upon completion of all the requirements specified in the Letter of Intent, the Sacco shall notify SASRA so that an independent on site inspection can be conducted to ascertain compliance. The inspection will be carried out within 30days from date of notification.

3.4 Fourth stage: Letter of Compliance

Upon completion of on-site inspection, if SASRA is satisfied that the Sacco Society has complied with all the conditions as stated in the letter of intent, it shall issue a compliance letter allowing the Sacco Society to pay the license fees within 30days.

3.5 Fifth stage: Issuance of a License

SASRA shall issue a license to the applicant Sacco Society upon payment of license fee of Ksh.50,000 (fifty thousand shillings) for head office and Ksh.20,000 (twenty thousand shillings) for each branch. The license shall be issued within 14days from the date of payment of the license fees.

4. What happens if a Sacco Society operating a FOSA at the commencement of the Regulations does not apply for license within the twelve months provided?

In line with Section 23(1), such a Sacco Society is in contravention of the law and the officers liable to the actions stipulated in section 23(2) of the Act among others.

5. Other matters

5.1 What happens after licensing of a Sacco Society?

a. The Authority shall within fourteen days from date of licensing publish in the Kenya gazette particulars of any newly licensed Sacco society.

b. At the beginning of each year and not later than 31st January, the Authority shall publish in at least one newspaper of national circulation particulars of licensed Sacco societies.

5.2 When is renewal of a license due?

A licensed Sacco Society will be required to apply for renewal of a license at least ninety (90) days before the expiry of its operating license in respect of its head office and any other place of business. The expiry date for all licenses will be 31st December.

Subscribe to:

Comments (Atom)